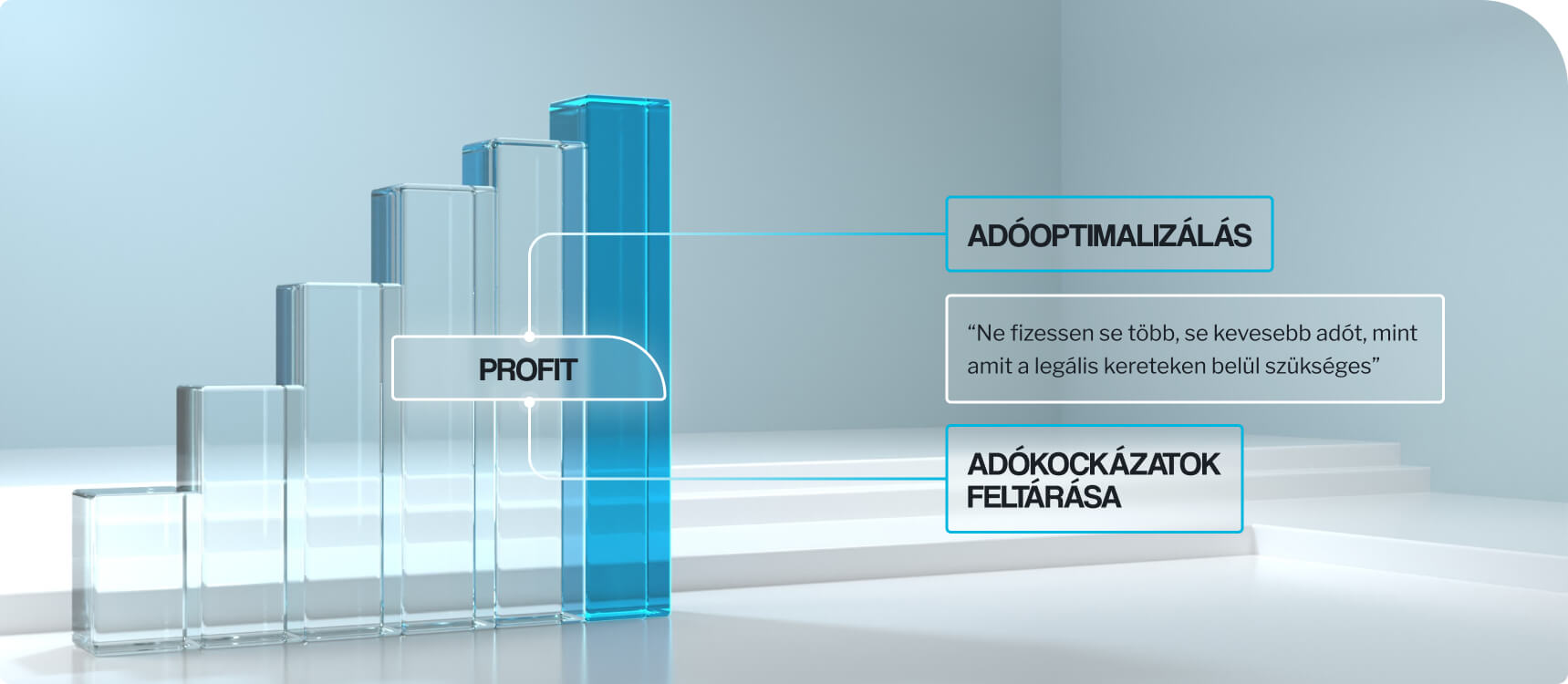

Tax Optimisation – Lawful Tax Reduction Within Legal Frameworks

Your business is our focus!

For businesses, tax liabilities represent a significant cost; however, with proper planning and optimisation, savings amounting to millions can be achieved. The objective of tax optimisation is to ensure that, while fully complying with statutory regulations, a business makes use of the most advantageous tax structures available. ICT Európa supports you throughout this process.

Scroll down for more information!

Contact us!

Please note:

At present, we are unable to accept sole proprietorships, as our services are primarily tailored to corporate entities. Thank you for your understanding.

Why is tax optimisation important?

Tax optimisation is a strategic tool for businesses, enabling them to reduce their tax burden by making full and lawful use of available tax opportunities. The aim is not tax avoidance, but the conscious application of applicable laws and tax allowances to ensure that a business or individual pays no more tax than legally required.

During tax optimisation, we examine factors such as the selection of the most appropriate tax regime, the utilisation of tax allowances and tax base reduction opportunities, and the structuring of costs in a way that minimises tax liabilities.

Tools such as the creation of development reserves, the proper accounting treatment of leasing expenses, or tax incentives related to research and development activities can all be highly effective elements of tax optimisation. A well-designed tax strategy not only impacts a company’s financial results for the current year but also supports long-term, stable and sustainable operations, while ensuring regulatory compliance and maintaining competitiveness. Tax optimisation is applicable not only to legal entities, but also to private individuals.

We know your challeges

A truly strategic partner for the long term

Discover the most common challenges companies face — and how we can help you overcome them.

Do you feel that your company is paying too much tax?

You are not alone. During our external tax reviews, we identify previously unrecognised tax optimisation opportunities in more than 90% of our clients’ cases. Many companies have unfortunately been paying more tax than necessary for years. Let us assess whether your business is eligible for tax allowances or tax base reduction opportunities that may have remained undiscovered so far.

Does your accountant not provide tax optimisation ideas?

Accounting is primarily a financial reporting discipline, which is why tax advisory has evolved into a distinct profession. We often find that businesses mistakenly assume it is their accountant’s responsibility to identify tax optimisation opportunities. Tax advisors, however, specialise specifically in identifying and optimising taxation opportunities.

Are you concerned about how your accountant will react to an external tax review?

Most accountants view our work as a form of support, as our objective is shared: contributing to the success of your business. In many cases, accountants themselves seek our assistance on complex professional matters, making the cooperation mutually beneficial.

Would you like to ensure your tax compliance is fully secure?

You can rely on us to achieve your goals.

How we work with you

Following the signing of the engagement agreement, our professional leaders assign your company to the appropriate experts.

Our controlled and supervised workflows guarantee operational security.

A dedicated accountant and accounting team leader approach your matters from a unified perspective, with a clear focus on practical, solution-oriented execution.

Our cooperation delivers tangible financial results.

We support invoice processing through automated solutions, improving both efficiency and communication.

We have the time and capacity to focus on your business.

We bring international insight and experience in both accounting and taxation.

We offer a comprehensive service portfolio, complemented by tax advisory, transfer pricing, legal services, HR support, and statutory audit services provided through independent partners.

Save more tax while increasing employee satisfaction!

- Learn more about our Synergy HR + Tax service

We understand your challenges

Why choose us?

Over 15 years of experience in tax advisory services

Our tax experts have completed tax reviews for hundreds of companies, and we leverage this accumulated experience to the benefit of your business.

Up-to-date knowledge of tax legislation

Tax regulations and opportunities change frequently. Our tax advisors continuously monitor legislative developments and incorporate the latest changes into our tax reviews.

Fast and efficient tax reviews

Over the years, we have developed and refined a proven methodology for tax audits and reviews. As a result, we work efficiently and purposefully, allowing you to benefit from the results without unnecessary delays.

International support — in English

We provide consultations and presentations in English to ensure that company owners or management of parent companies fully understand the results of the tax review.

Industry-specific expertise

Industry knowledge is critical in taxation to achieve optimal results. ICT Európa’s tax advisors possess extensive industry-specific expertise, providing an additional level of assurance for our clients.

Full professional liability

We assume financial liability for the professional advice provided during our tax reviews. This represents a further guarantee and security for our clients.

Your business at the center

We will find the best tax options for you!

Monthly management report, sent after the month in question

No surprises at the end of the year!

Our monthly closures give you peace of mind

Your company

Tailored turnover, profit and balance sheet datas

We show the amount of corporation tax and business tax to be paid in the future

We calculate tax and tax base adjustments and possible allowances on a monthly basis.

Details

Stay ahead of your competitors in taxation as well!

Our goal in tax optimisation is to enable our clients to reduce their tax burden by maximising lawful opportunities. To achieve this, our experts identify available tax allowances, tax base reduction options and cost-efficient solutions tailored to your business.

We apply methods such as the creation of development reserves, utilisation of investment tax incentives and deduction of leasing interest to minimise tax liabilities. In addition, we assist with transfer pricing documentation and VAT refund procedures, ensuring regulatory compliance while maximising savings.

No fixed date, let's talk about it!

Learn more about our Company!

Our Group in numbers

175+

Experts

50+

Professional publications per year

15+

Years of professional experience

350+

Satisfied clients

Testimonials

Our clients said

Átlátható, proaktív könyvelés

“I enjoy working with you because you are extremely efficient, our accounting has become transparent and easy to follow thanks to you, and you always respond quickly to my questions. The biggest advantage for me is that with you, accounting is not just a “mandatory task,” but you convert the numbers into valuable data that I can use to make decisions.”

Balázs Háromfai

Biobubi Franchise Kft. – CEO

Tax optimization

Enikő Bakó

CEO - Pan–Italia Kft.

Due diligence

"Based on its broad and high-quality professional coverage, the ICT group did an excellent job for us in carrying out the entire due diligence process, thus contributing significantly to the successful acquisition of Unichem Kft by our group's parent company, Donauchemie AG."

Antal Braunecker

Donauchem Kft. – CEO

Comprehensive, complex services

"We have experience with ICT in the areas of accounting, taxation, and auditing. Our daily collaboration works very well, and we receive professional support during our joint work. Their supportive attitude, professional knowledge, and teamwork are unquestionable. Based on our previous experience, we trust that they will perform their tasks with the highest level of professional expertise."

Katalin Pálinkás

WebEye Hungary Kft. – CFO

Legal services

“The ICT Europe team worked with maximum precision and speed on every project, ensuring that deadlines were always met. Thanks to the team's outstanding communication skills, legal issues were resolved quickly and efficiently, which contributed significantly to the success of our work. Their expertise and commitment enabled us to move forward smoothly, ensuring the highest level of service for our clients. The professional knowledge and commitment of the firm's staff ensured that we were supported with the highest quality legal services, so our collaboration was truly flawless.

László Derecskey

Belvárosi Nyomda Zrt. – CEO

Accounting and advisory

“I am very grateful to fate that I have a service provider like the ICT Group as my partner. Through the SLM system, accounting is very simple, up-to-date, and easy to track. In addition to accounting, they provide many consulting and legal services that are very useful in everyday life. The contact persons are highly trained in their fields, helpful, and, importantly, available when needed."

Zoltán Seprenyi

Zconcept Kft. – CEO

Legal services

“Over the past few years, we have used ICT Europe’s corporate and labor law services on several occasions and have been very satisfied with them. They have always provided professional and thoughtful answers to our questions. Throughout our collaboration, we have always felt their expertise and reliability, so we can confidently recommend them to anyone who needs high-quality advice."

Gergely Ujváry

HAFNER Pneumatika Kft. – CEO

Accounting

We chose ICT as our accountancy firm 7 years ago, we were welcomed by a professional team and the transition was smooth. Their professionalism, reliability and excellent communication have made this a balanced and harmonious partnership, whether it be for labour, payroll, accounting or tax. We work together in perfect harmony and seamlessly. As we operate a paperless office, we are happy to use the online system to upload documents, which supports our work with a wide range of statements and planning options.

Judit Bóna

CEO - Com-Forth Ipari Informatikai Kft.

General ledger

We switched from the risk of a small accountancy firm to the security of a professional accountancy firm. They created a structured order. They created security for accounting data. They anticipate the potential tax risks and tax benefits of each transaction. They provide fast and professional assistance in dealing with the tax authorities.

Róbert Kolonics

CFO - MICRO-TOP Kft.

Accounting

As a manager of a small business, I would never have imagined that "accounting" as a service could be run professionally, with responsibility! But I found what I thought did not exist!

Gábor Majoros

CEO - Enertech Hungária Kft.

Complex services

I like to work with you because, despite the fact that our company is not a simple structure (parent company in a 3rd country with a branch in another member state) and has a diverse supplier and customer base (domestic, EU and 3rd country), you are prepared, communicative, legally sound and up-to-date in your accounting tasks. It is a pleasure for me to be able to sit back and concentrate on other professional or managerial tasks!

Enrico Mák

CEO - Merico Zrt.

Complex services

Looking back on several years of successful and fruitful cooperation with ICT, I can confidently say that every day we confirm that it was the best decision to entrust our accounting, payroll and other consulting tasks to this team. The precise, accurate and comprehensive expertise that is concentrated in ICT is, for me, exemplary and respectable, and has been confirmed by many partners besides us. No doubt, we will continue to work with the ICT team in the future!

Bálint Farkas

CEO - Geodézia Zrt.

Legal services

“Több, mint 3 éve dolgozunk együtt az ICT-vel. A közös munkánk pont akkor kezdődött, amikor a cégünk fejlődése már megkívánt egy komplexebb könyvelői hátteret. Hideghívással kerestek meg minket, a tipikus „jókor voltak jó helyen” példája.

Elsőre profinak, magabiztosnak és megnyerőnek tűnt a csapat. Igyekeznek ’mindenben is’ támogatást nyújtani, amire egy cégnek szüksége lehet, az ajánlásaikkal több munkakapcsolatot alakítottunk már ki ügyvédi, vagy akár controlling területen.

Az állandóan változó világ minden cég számára hoz kihívásokat. Az ICT kollégái rugalmasan, pozitívan állnak minden újdonsághoz – a véleményüket is elmondják, de ha szükséges, tanulnak is velünk együtt.”

Varga Zsuzsanna

Két-KATA Kft. – Gazdasági vezető helyettes

More services

Related services

The HR 361 Audit is not just a standard review process. It is a comprehensive approach that covers every aspect of human resources management.

FAQ

FAQ

Tax advisors ensure that your business remains compliant with applicable regulations while minimising tax liabilities, thereby increasing profitability. Their work also helps mitigate tax-related risks.

Small, medium-sized and large enterprises for whom tax security, planning and optimisation of taxation processes are of strategic importance.

Tax advisory is an ongoing service, as tax legislation changes regularly. Continuous advisory support provides sustained financial benefits for businesses.

During the initial consultation, we gain a comprehensive overview of your company’s tax position and define the key objectives. This typically takes approximately one hour.

Our experts continuously monitor legislative changes to ensure ongoing compliance with current regulations. In addition, our professional liability insurance provides financial guarantees.

Contact

Contact us!

Our colleagues will contact you within 24 hours will provide you with further details.

91-93. Budafoki street, Budapest, 1117

IP West Office Building 4th Floor

Contact us!

Please note:

At present, we are unable to accept sole proprietorships, as our services are primarily tailored to corporate entities. Thank you for your understanding.