As of 1 July 2025, significant legislative changes will come into force, directly affecting payroll, tax allowances, and simplified employment. Below we summarise the most important updates — from changes to the family tax benefit to the revised rules on infant care allowance (CSED), childcare allowance (GYED), and the new deduction regulations.

The amount of the family tax allowance will increase.

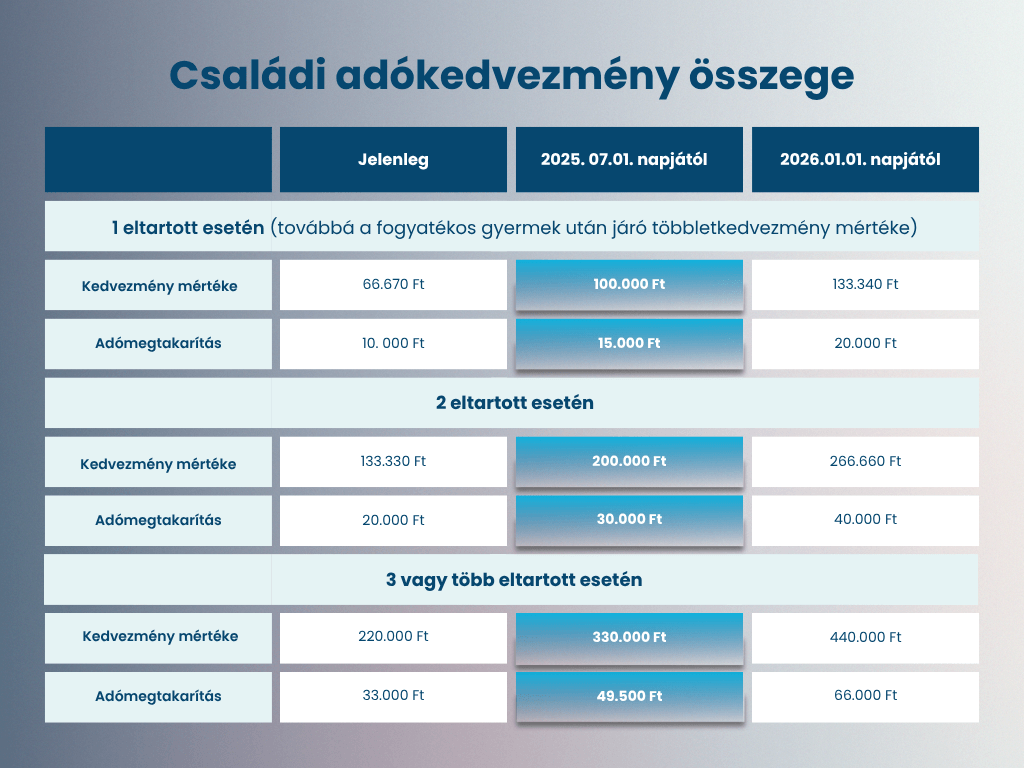

As part of the first phase, from 1 July 2025, the amount of the family tax allowance — depending on the number of dependents — will be as follows per eligible dependent per month of entitlement:

- HUF 100,000 in the case of one dependent

- HUF 200,000 in the case of two dependents

- HUF 330,000 in the case of three or more dependents

From July 2025, the family tax allowance for a dependent who is permanently ill or severely disabled may be claimed in an increased amount — by HUF 100,000 per month of entitlement.

The second phase will take effect from 1 January 2026.

* per eligible dependent per month of entitlement

The tax allowance changes taking effect on 1 July 2025 do not require the submission of a new declaration if a previous one has already been filed. A new declaration is only necessary if, in the case of shared entitlement, the allowance was specified as a fixed amount and the claimant wishes to modify that amount.

From 2025 onwards, the tax benefits for individuals under the age of 25 and for first-time married couples may only be claimed by Hungarian citizens, as well as — provided that the eligibility criteria are met — citizens of EEA member states or of non-EEA countries bordering Hungary (Ukraine, Serbia).

The tax benefit for mothers under the age of 30 and the family tax allowance may only be claimed by individuals who are Hungarian citizens, or — provided that the eligibility criteria are met — by those entitled to family allowance, disability allowance, or other similar benefits under the legislation of any EEA member state or a non-EEA country bordering Hungary (Ukraine, Serbia).

A 120-day limit will be introduced in simplified employment.

According to Section 1 (4) of the Act on Simplified Employment (Efo Act), effective from 1 July 2025:

“If the employee:

a) is employed for seasonal work,

b) is employed for casual work, or

c) enters into multiple employment relationships for both seasonal and casual work, the combined duration of such employment relationships may not exceed 120 days within the same calendar year.”

A key change effective from 1 July 2025 is that an employee may work a maximum of 120 days per calendar year under simplified employment, and this 120-day limit includes all days worked under simplified employment with other employers as well.

To verify this condition, employers will be provided with a prior electronic query option by the Hungarian Tax Authority (NAV).

As of 1 February 2025, the public burden (tax and contribution) payable by the employer per employee per calendar day of employment is as follows:

- in the case of agricultural and tourism-related seasonal work: HUF 2,200 per day

- in the case of casual work: HUF 4,400 per day

- in the case of film industry extras: HUF 8,700 per day

The Act on Judicial Enforcement will be amended.

Currently: Section 62 (1) In the course of deductions under Section 61, the portion of monthly wages that does not exceed HUF 60,000 is exempt from enforcement. This exemption does not apply in the case of enforcement of child support and costs related to childbirth (hereinafter: child support).

From 1 July 2025: Section 62 (1) In the course of deductions under Section 61, the portion of monthly wages that does not exceed 60% of the net amount of the statutory minimum wage shall be exempt from enforcement. This exemption does not apply in the case of enforcement of child support and costs related to childbirth (hereinafter: child support).

The net amount of the family tax allowance, as defined by the Personal Income Tax Act, is exempt from wage garnishment.

Unchanged: Section 63 From the remaining amount after deduction, the portion of monthly wages exceeding HUF 200,000 may be subject to enforcement without limitation.

CSED, GYED, and the Adoption Allowance will be exempt from personal income tax (PIT).

As of 1 July 2025, the infant care allowance (CSED), childcare allowance (GYED), and adoption allowance will be fully exempt from personal income tax.

As a result of this measure, mothers will receive the full amount of the CSED benefit corresponding to their previous gross salary.

The childcare allowance (GYED), which can be claimed until the child turns two (or three in the case of twins), will only be subject to a 10% pension contribution. However, the family contribution allowance will continue to be applicable to this amount. Currently, the maximum gross amount of GYED is HUF 407,120 per month.

It will be permitted to engage in gainful employment while receiving CSED.

After the child reaches the age of three months, the mother is free to decide whether she wishes to resume gainful employment alongside childcare responsibilities.

CSED will continue not to be granted if the mother engages in any form of gainful employment — except for foster parent employment — within 90 days from the date of the child’s birth.

However, from 1 July 2025, after the above-mentioned period has expired, mothers who engage in gainful employment — except under a foster parent employment relationship — will become eligible for the infant care allowance (CSED).

In this case, the amount of the CSED will be 70% of the established daily base instead of 100%.

Changes will take effect from 1 October 2025.

Personal income tax exemption for mothers with three children

As of 1 October 2025, all mothers — regardless of age — will be entitled to a personal income tax exemption if they are eligible for family allowance for at least three children, or were previously eligible for such allowance for three children for a period of at least 12 years.

The personal income tax exemption applies exclusively to income earned from work (e.g. salaries, income from self-employment or agricultural primary production, and fees from contractual engagements).

The personal income tax exemption will not apply to income such as dividends, capital gains, or income from real estate rental.

As of 1 January 2026, additional tax benefits will be introduced.

Personal income tax exemptions are coming for mothers under 30 and for mothers raising two children.

Important: The application of the above changes requires increased attention regarding payroll processing, declarations, and eligibility assessments. It is advisable to prepare in advance to ensure that both employers and employees can fully benefit from the opportunities.

If you would like assistance with the practical implementation of these changes or with preparing your employer administration, please feel free to contact us.

Our blog article is authored by Adrienn Horváth, Professional Director of Payroll at ICT Európa.